Millions of Americans are ditching their day jobs in pursuit of starting a business that will give them more happiness, fulfillment and—hopefully—income. But starting a successful business is no easy feat, and with so many challenges ahead, even the decision of which state to start a business in can influence your odds of success.

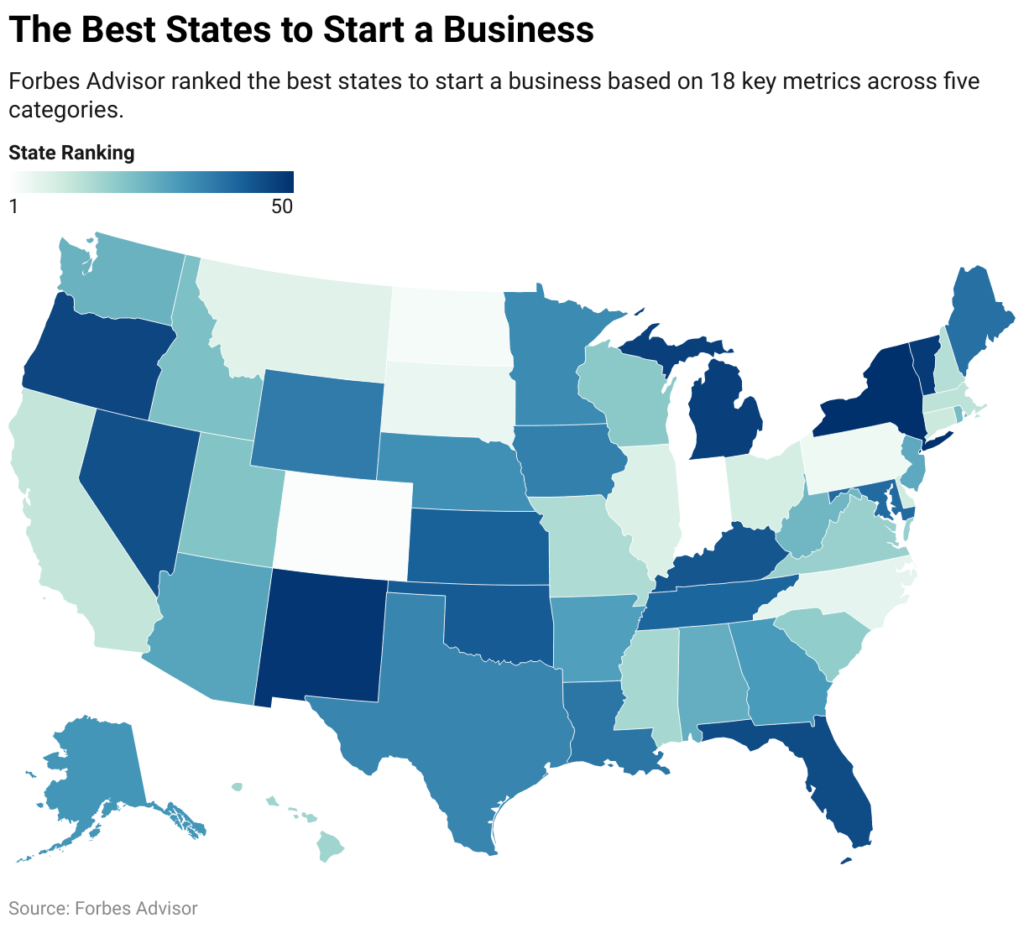

To rank the best states to start a business in 2023, Forbes Advisor analyzed 18 key metrics across five categories to determine which states are the best and worst to start a business in. Our ranking takes into consideration factors that impact businesses and their ability to succeed, such as business costs, business climate, economy, workforce and financial accessibility in each state.

Ranking: The Best States to Start a Business

| Rank | State | Total Weighted Score | Score out of 100 |

|---|---|---|---|

| 1 | Indiana | 32 | 100 |

| 2 | Colorado | 31 | 98 |

| 3 | North Dakota | 30 | 96 |

| 4 | Pennsylvania | 30 | 94 |

| 5 | South Dakota | 29 | 92 |

| 6 | North Carolina | 29 | 90 |

| 7 | Montana | 29 | 88 |

| 8 | Illinois | 29 | 86 |

| 9 | Ohio | 29 | 84 |

| 10 | Delaware | 28 | 82 |

| 11 | Connecticut | 28 | 80 |

| 12 | California | 27 | 78 |

| 13 | Massachusetts | 27 | 76 |

| 14 | New Hampshire | 27 | 74 |

| 15 | Missouri | 26 | 71 |

| 16 | Mississippi | 25 | 69 |

| 17 | Hawaii | 25 | 67 |

| 18 | Virginia | 25 | 65 |

| 19 | South Carolina | 25 | 63 |

| 20 | Wisconsin | 24 | 61 |

| 21 | Utah | 24 | 59 |

| 22 | Idaho | 24 | 57 |

| 23 | Rhode Island | 24 | 55 |

| 24 | West Virginia | 24 | 53 |

| 25 | Washington | 24 | 51 |

| 26 | Alabama | 24 | 49 |

| 27 | New Jersey | 23 | 47 |

| 28 | Arizona | 23 | 45 |

| 29 | Arkansas | 23 | 43 |

| 30 | Georgia | 23 | 41 |

| 31 | Alaska | 23 | 39 |

| 32 | Nebraska | 22 | 37 |

| 33 | Minnesota | 22 | 35 |

| 34 | Texas | 22 | 33 |

| 35 | Iowa | 22 | 31 |

| 36 | Wyoming | 22 | 29 |

| 37 | Louisiana | 22 | 27 |

| 38 | Maine | 22 | 25 |

| 39 | Maryland | 21 | 22 |

| 40 | Tennessee | 21 | 20 |

| 41 | Kansas | 21 | 18 |

| 42 | Oklahoma | 21 | 16 |

| 43 | Kentucky | 21 | 14 |

| 44 | Nevada | 21 | 12 |

| 45 | Florida | 21 | 10 |

| 46 | Oregon | 19 | 8 |

| 47 | Michigan | 19 | 6 |

| 48 | Vermont | 17 | 4 |

| 49 | New Mexico | 16 | 2 |

| 50 | New York | 16 | 0 |

Key Findings

- Overall best state to start a business: Indiana ranks as the best state to start a business. With a combination of low taxes, a reasonable cost of living and a prime workforce, Indiana provides ideal conditions for new businesses to succeed.

- Overall worst state to start a business: New York ranks as the worst state to start a business. A high cost of living, high unemployment rate and a relatively low survival rate of 79% make the city that never sleeps a less-than-ideal place to start a business.

- Best and worst states by business survival rates: Washington state has the highest year-to-year business survival rate across the nation at 89%. While Hawaii has the lowest survival rate at just 75%.

- Rate of new businesses by state: Entrepreneurs in Florida, Texas, and North Carolina have seen a net increase in new businesses of 29,995, 15,656, and 14,581 respectively, since 2020. Meanwhile, New York saw the largest decrease in business with 3,550 less business in 2021 than in 2020.

- States with the highest and lowest cost to register a business: Startups in Massachusetts have to shell out the most cash to get started with the highest formation fee across the nation at $500. Whereas, Kentucky has the lowest formation fee in the US, at just $40.

- States with the best workforce: For businesses looking to hire degree-level workers—Massachusetts, Colorado, and Connecticut provide the best workforce, with over 40% with a college education. Meanwhile, California, Alaska, and Colorado have the largest working population.

Here are the five best states to start a business in 2023:

1. Indiana

| Business Survival Rate | Tax Rates | LLC Formation Fee |

| 83.6% (national average is 80.6%) | Income tax: 3.23% (flat) Corporate tax: 25% | $100 |

Indiana ranks as the number one best state to start a business, largely because the Hoosier State offers a business-friendly climate with a low flat tax rate of 3.23%, an above-average business survival rate and a healthy amount of funding opportunities. In fact, the Small Business Association (SBA) reported that Indiana had about $13.1 million in total funding for small businesses within the state last year.

It’s not only Indiana’s business climate that landed it at the top of our list. Entrepreneurs in Indiana enjoy a low cost of living that is 15% lower than the national average along with a lower than average unemployment rate of 2.8%, illustrating the state’s eager workforce.

2. Colorado

| Business Survival Rate | Tax Rates | LLC Formation Fee |

| 81.9% (national average is 80.6%) | Income tax: 4.55% Corporate tax: 24% | $50 |

The second-best state to start a business is Colorado. Not only is it a paradise for the outdoor adventure lovers among us, but it also ranks first in the nation for its startup density, illustrating the state’s entrepreneurial nature—and its allure for those with one. With such a high concentration of startups, new business owners will be in good company in Colorado.

Colorado is a business-friendly state with one of the nation’s lowest business formation fees of just $50 to register an LLC, and the ability to launch businesses in widely restrictive industries such as recreational cannabis. But while Colorado helps to make business ownership accessible, an income tax rate of 4.55% and a corporate tax rate of 24% doesn’t offer the best tax climate. Still, businesses in Colorado remain poised for success with an above-average survival rate.

3. North Dakota

| Business Survival Rate | Tax Rates | LLC Formation Fee |

| 78.3% (national average is 80.6%) | Income tax: 2.90% Corporate tax: 24% | $135 |

Next up is North Dakota. While it’s not a state that has been widely recognized as the best state to start a business, it has made a great deal of headway in recent years. Thanks largely to its business-friendly climate with a corporate tax rate of only 4.31% and a personal income tax rate of 2.1% (the lowest in the nation), North Dakota has become an attractive option for tax-conscious entrepreneurs.

Entrepreneurs in North Dakota don’t just benefit from its low taxes; new business owners and founders also receive the highest average funding per business in the nation. At $34,894 per business on average, it’s nearly 50% more than the national average, and it’s nearly 3 times higher than Iowa, with the lowest funding per business in the country.

4. Pennsylvania

| Business Survival Rate | Tax Rates | LLC Formation Fee |

| 83.3% (national average is 80.6%) | Income tax: 3.07% Corporate tax: 29% | $125 |

Pennsylvania lands at number four on our list of the best states to start a business, largely due to its availability of resources and funding for entrepreneurs. For example, the total small business loan funding in Pennsylvania is double that of the national average at $27.7 million. Though this figure is dwarfed by California with the nation’s highest total funding of $97.1 million, Pennsylvania’s funding is spread across fewer businesses, driving the average amount per business to be over 20% higher than California’s and 17% above the national average.

Though Pennsylvania is the most expensive state in terms of cost of living to make it into the top five best states to start a business, it is quickly becoming a popular alternative to New York with a lower cost of living and a higher business survival rate. On top of that, Pennsylvania’s income tax is less than one-third of New York’s at 3.07%—compared to 10.9%.

5. South Dakota

| Business Survival Rate | Tax Rates | LLC Formation Fee |

| 81.0% (national average is 80.6%) | Income tax: 0% Corporate tax: 21% | $150 |

Rounding out our top five best states to start a business is South Dakota. The Mount Rushmore State stands out for its business-friendly tax climate with a 0% income tax and 21% corporate tax rate. With low tax rates, businesses can pocket more of their profits, in addition to having a higher availability of financial assistance and resources. South Dakota’s average funding per business is over $10,000 more than the national average of $21,273. Perhaps not surprisingly, this may help reveal why South Dakota also has a higher than national average business survival rate.

Another area where South Dakota stands out is that its cost of living is about 5% below the national average, yet its average per capita personal expenditures is just above the national average. What this indicates is that its spending power on elastic goods that people want to have (as opposed to inelastic that we need to have) is stronger than states such as New York, which has the nation’s highest average per capita personal expenditures at 13% above national average combined with a cost of living that is 33% above the national average.

Methodology

To determine the best and worst states to start a business, the Forbes Advisor team examined 18 metrics across five categories: Business Costs, Business Climate, Financial Accessibility, Economy, and Workforce. Each metric was given an individual weighting to provide every state a score scaled out of 100.

Business Costs: 30%

This metric includes income tax, corporate tax, and property tax rates as of January 1, 2022 from The Tax Foundation. Formation fees for each state came from Forbes Advisors research, the minimum wage in each state from the Department of Labor, and the number of natural disasters from the Federal Emergency Management Agency (FEMA) as of 2022.

- Income Tax (3 points)

- Corporate Tax (3 points)

- Property Tax (3 points)

- Formation Fee (9 points)

- Minimum Wage (9 points)

- Number of Natural Disasters (3 points)

Business Climate: 20%

This metric uses data from the Small Business Administration (SBA) State Profiles to find the total net increase or decrease in businesses since 2020. We’ve used data from the Bureau of Labor Statistics for business survival rates. We used data from the SBA to divide the number of businesses in each state by the number of small business administration locations in each state to determine the availability of SBA locations for business owners in 2023.

- Total Growth in Small Business Since 2020 (8 points)

- Business Survival Rate (8 points)

- Number of Businesses per Small Business Administration Location (4 points)

Financial Accessibility: 20%

For this metric, we used data from the Small Business Administration State Profiles to calculate the total amount of business funding available in 2021.

- Average Funding (20 points)

Economy: 15%

The metric used data from the Bureau of Economic Analysis to find personal expenditures per capita in 2021. We used Statista to find the gross domestic product per capita and the cost of living index in each state.

- Per Capita Personal Expenditures (6 points)

- Gross Domestic Products per Capita (3 points)

- Cost of Living Index (6 points)

Workforce: 15%

For this metric, we used data from the Bureau of Labor Statistics to find the unemployment rate in each state and the percentage of workers that have earned a degree. Using data from the Census Bureau, we calculated how many people in each state are of working age (between ages 15-64). We calculated the number of universities per capita by utilizing data from the National Center for Education Statistics for the total number of degree-granting institutions in each state.

- Unemployment Rate (4.5 points)

- Percent of Population that is of

- Working Age (4.5 points)

- Percent of Degree-level Workers (3 points)

- Number of Universities and Colleges Per Capita (3 points)

Conclusion

While all business owners have to be dedicated to success and adapt to the various challenges they inevitably face, outside factors such as taxes, access to financial resources and the local economy will all play into building a successful business. Though location is just one small piece of the puzzle, it’s important to consider all factors when starting a business to give yours the best chance possible.

For entrepreneurs looking to get started on their business, visit the Forbes Advisor guide on how to start a business. Or if you’re ready to get started, check out the best LLC services to help move things along.

source: forbes.com